Are You Tired Of Always Being Worried About The IRS? If The Answer Is YES, Then You Can’t Afford To Miss Out On This Opportunity…

Ask Yourself This: Are You Willing To Risk Your Business And

Lifelong Dream Getting Frozen By The IRS?

Imagine waking up one day to a notice from your bank that the IRS has frozen your bank accounts, you cannot send money, pay your vendor or make payroll, and that your future has one foot in its grave…

You’ve spent years working 24/7 to build the stable, financially free future that you’ve always looked forward to, staying up when others slept, showing up at the office before anyone else, and giving your 120% day-in-day-out.

However, you forgot about one thing. One thing that can single-handedly bring down your years of hard work in minutes, and that is taxes.

You’ve always had that thought in the back of your head, but there was always something more urgent, something more important, and a long list of tasks that you needed to get done before thinking about your taxes.

And now, just when things started to pick up, you find yourself at your desk, staring rock-bottom in the eyes, and wondering how you can fix this, or what you could’ve done to stop this from happening.

And whether you’ve been in this situation before, or we’ve just described your worst nightmare, you’re not alone: Today, 1 in 5 small business owners don’t even know their tax rates.

Right Now, Much Like Most Business Owners, Every Time The IRS Is Brought Up In A Conversation, You Immediately Think Of Tax Trouble…

- YOU START ASKING THE SAME QUESTIONS:

- Did I pay enough taxes this year?

-

Did I miss something that could be crucial to my business accounts?

-

Have I hired the right people to take care of my taxes?

-

If I didn’t, how will I be able to tell before disaster strikes?

Then, you start to wonder, with a business of your size, you’re worrying this much about taxes: So how do the millionaires and billionaires of the world manage to keep growing without the IRS showing up at their doors?

That’s where you want to be: Confident in your taxes, comfortable with what you pay each year, and on good terms with the IRS, which will help you direct 100% of your focus on growing your business!

Today, That’s Exactly The Opportunity We’re Here To Offer You: Expert Help To Stay On Track With Your Taxes 24/7, And Gain Clarity Over Every Tax Report And Taxable Income You’re Making Without Relying On The IRS.

We’re My Tax Alarm, and our mission is to help businesses and entrepreneurs avoid getting their hard work stolen from them by the IRS.

My Tax Alarm puts your tax transcripts on a daily flow of reminders

to our in-house team of tax experts and attorneys.

The second we get an alert that you’re behind on a payment, the IRS is filing a lien against your property, or the IRS has a question about your tax return and could potentially audit you, we immediately let you know so you can take action.

Why do you need us?

Because while the IRS has a reminder and alert system, you don’t get alerted until they’ve taken action! With our experts, you’ll get notified the second your account gets flagged.

Ditch The Guesswork And Join The Pros!

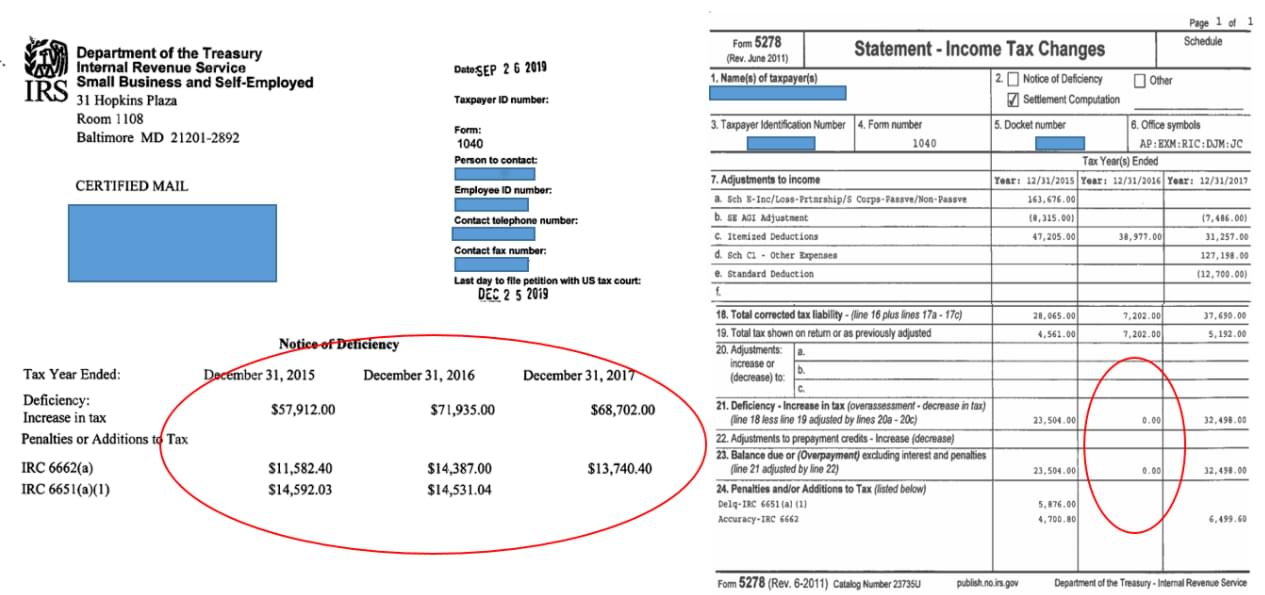

My Tax Alarm was created by Claudia Moncarz, an expert tax attorney with over 20 years of experience and who has erased over $3,000,000 in back taxes for her clients.

During her many years of practice, she saw how most people got in trouble because they forgot to report some income, took a misguided deduction, or simply did not plan well for a big tax bill at the end of the year.

She also recognized that many of these problems could be avoided or minimized with some warning and planning; thus, the idea of My Tax Alarm came about.

As featured on:

Aside from cashflow, what matters to you is your confidence in your day-to-day tasks. Because if you’re constantly waiting for the guys in suits to show up at your office, you’ll be cutting your business short. If you are worried about the IRS, you are not making money.

We have the nation’s most sought-after professionals on deck, and we’re here to help you save money, save time, and get the most out of your taxes without stepping into the red.

What's In It For You?

Today, You’re Still In The IRS’s Safe Zone, But In The Next Unexpected Turn Of Events, You Might Not Have The Time Or The Resources To Save Your Business…

Subscribe To My Tax Alarm Today for $490 A Year Or $49 A Month,

And Keep Your Tax Transcripts Under Control 24/7!

“START PLAN NOW”

Set It And Forget Your Worries

Annual Plan

$490

Per year

Bonus: PERFECT MATCH – Did you know that if the information on your tax return doesn’t match what the IRS has in your file, it WILL trigger an audit? Our “Perfect Match” report will make sure your return matches!!

($799 value)

Bonus: TWO MONTHS FREE – Sign-up for the annual plan and pay for 10 months instead of 12 months. ($98 value)

FAQ

Why do I need my IRS Transcripts monitored?

The IRS received over 80 million in funding to update its compliance system and hire over 87,000 collections agents. As a result, audits will go up, and the IRS’ collection effort will ramp up. With My Tax Alarm, you will know if you are in trouble before you receive a letter.

Is my information secure?

Yes, we have taken the necessary measures to keep your personal information confidential.

How often do I get alerts?

Daily. Think of this update as your credit score for your IRS account; it provides you with the health of your IRS account. Unlike the IRS, which only sends you threatening letters demanding payment. We also send you a monthly report, in which we inform you of the balance of any IRS debt, alert you if a return has underreported income (a significant audit risk), identify any liens that are present, and more.

Can’t I contact the IRS to get this information myself?

Unless you like calling the IRS every day and waiting on the phone for hours at a time, the headaches of trying to navigate this world by yourself simply aren’t worth the effort. This is all we do - so let us do it for you!

What are your qualifications?

This program was created by Claudia Moncarz, an expert tax attorney with over 20 years of experience. After working with hundreds of clients she saw how most business owners got in trouble because they forgot to report some income, took a misguided deduction, or simply did not plan well for a big tax bill at the end of the year. Something that Claudia whole heartly knows could have been avoided. Also, Claudia has a Master of Law in tax law (which means she studied for an extra year in law school to master the subject of tax law) and is a former law school professor.

Can I use My Tax Alarm for my business?

Yes, you can.

Can I cancel at anytime?

Yes, you can cancel anytime. There is no contract to sign.

Will you represent me in front of the IRS?

No, this service is only to notify you of any changes in your IRS tax transcript. We do not represent you in front of the IRS. However, through our sister company (Moncarz Law Firm) we got you covered. Moncarz Law Firm can represent you in front of the IRS for an additional fee if you choose to.

How will you notify me of a change in my IRS transcript?

During our daily monitoring of your tax transcripts, we will let you know if we see a change. You will receive an email from us letting you know what the change is so that you will not be surprised when you receive the IRS letter.

Need Support?

Email Support: